Editor's note: Seeking Alpha is proud to welcome Matt Evans as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

NVR, Inc. ( NYSE:NVR ) is one of the largest homebuilders in the United States today and currently sits at No. 6 with respect to revenues. This company is a bit under the radar due to a few reasons but that doesn't mean that this is not a great company worth consideration. On the surface this company looks like it is fairly valued based on its P/E ratio of 17, but what I would like to do is take a deeper look into this company to see why there is not only value, but is a standout among its peers.

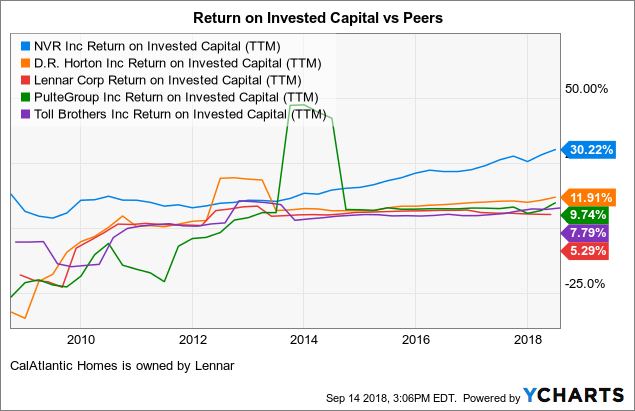

You can see in the chart above that NVR has a much higher rate return on invested capital than its leading peers. This is going to give us some great insight into what sets NVR's business model apart from its peers and why it could become a leader in the homebuilding sector. As a side note, YCharts defines ROIC as net income/average invested capital. Technically, they should be using after-tax operating income since this is a firm number and net income is an equity number, but the point is still valid.

NVR has four different entities that it operates under which include Ryan Homes, Heartland Homes, NVHomes and its loan origination business NVR Mortgage Finance.

Ryan Homes target homebuyer is towards the first time move-up buyers and operates in Maryland, Virginia, Washington, D.C., West Virginia, Pennsylvania, New York, North Carolina, South Carolina, Florida, Ohio, New Jersey, Delaware, Indiana, Illinois and Tennessee.

Both NVHomes and Heartland Homes are targeted toward move-up and luxury buyers. NVHomes operates in Delaware and the Washington, D.C., Baltimore, Md., Philadelphia, Pa., and Raleigh, N.C., metropolitan areas. Heartland Homes operates in the Pittsburgh, Pa., metropolitan area.

NVR Mortgage Finance is their loan origination and title services branch that offers financing solutions exclusively to customers of NVR for their home purchases.

What separates NVR from other home builders is their use of lot purchase agreements for building lots instead of buying undeveloped land and then developing lots to build homes. NVR sets these agreements up with third party developers that requires a 10% deposit of the purchase price for the lots. These agreements allows NVR to treat these undeveloped lots as options so that at any time they can have the option to not pursue development of the lots. This allows NVR to keep capital from being tied up in land development that may not be ready to be capitalized on. This is how they are able to maintain a high ROIC, which ultimately will lead to more FCF and sustainable growth.

One of the unique things that I noted is that management does not host any earnings call for either the quarterly or annual reports so this does make things a little difficult when trying to gauge the temperament of management. A feather in their cap though is that most of upper management has been with the company for a number of years. Paul Saville is the current CEO and President and has been so ever since 2005 and has been with the company since 1981. Daniel Malzahn is the current CFO and Treasurer and has been with the company since 1994. While this can seem like a knock against them, keep in mind that they have been around the same disciplined culture that has helped NVR become what it is today.

As of August 1,2018 the Board has authorized a $300M share repurchase program that at current prices today would represent about 133 thousand shares repurchased. You can see in the graph below that management has been shareholder friendly and have continued to return capital to shareholders.

As with all investments there are risks and while NVR operates more efficiently than its peers, they are still subject to economic conditions the can hinder their overall business. There is current concern that the millennial generation is being held back by student loan debt and are delaying the purchase of their first home. While these claims may seem exaggerated, this needs to be considered as this could impact the future of homebuilders in general.

One risk that NVR faces is cancellations of new home purchase either due to failure to secure financing or the inability of the purchaser to sell their previous home. Their current cancellation rate was about 14% in 2017 and 15% in 2016 according to their latest annual report (page 2). While this does not necessarily mean that this revenue is lost, it does mean that there could be excess inventory sitting around for an extended period time that could expose the company to deteriorating market conditions.

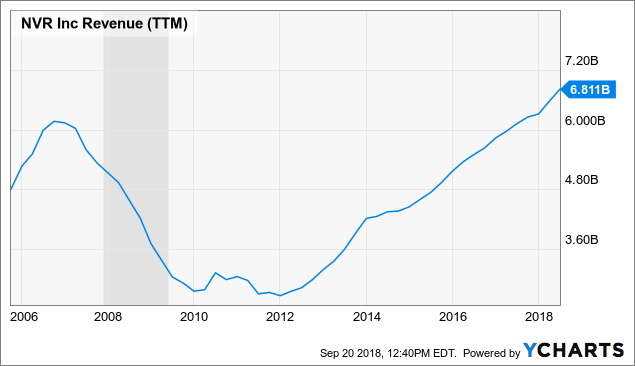

As you can see above the major risk that does present itself is the overall health of the economy (the grayed out portion represents the Great Recession). While this seems like stating the obvious, it is worth noting as you should be aware that as the correlation that exists here. While I do not believe we will see another recession hitting the housing market like the financial crisis again, as investors we should be prepared for the volatility that is inherent in owning stock in the homebuilding sector.

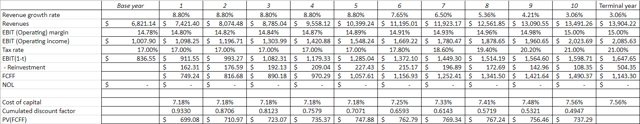

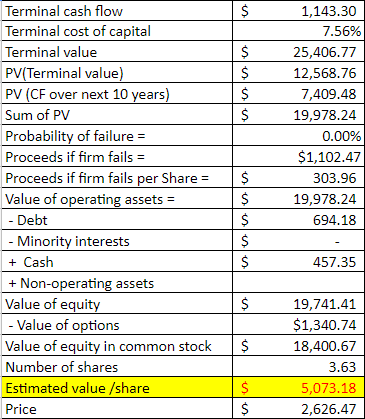

Being a long term investor, my goal is to find what a company is really worth through intrinsic valuation. My preferred method is to use DCF to approximate (this is the key word here) the underlying fundamental value of a company. I know some are uncomfortable with the assumptions made in DCFs and would rather use relative valuation, but for me I would rather make assumptions about a single company than to make an assumption that an entire market is correct.

I used a three stage, FCFF model for my valuation and I assumed that growth in perpetuity will not exceed that of the current 10 year T-Bond rate which as of writing this is 3.06%. I estimated the cost of WACC to be 7.18% and I use that as my discount rate. I do adjust operating margins for operating leases which changes margins upward by about 0.5% and treat operating leases like debt. I assumed that operating margins would steadily grow to 15% to the terminal year based on their current rising margins. I assumed revenues will grow by about 8.8% a year for the first 5 years (which was based on their current and past reinvestment) and then decline to growth equal to the current risk free rate. I assumed that their cost of capital would grow to be about that of a mature company, which is the risk free rate plus 4.5%.

Based on my estimations, NVR's stock represents great value at almost a 50% discount.

NVR has shown itself to be a durable and efficient home builder that operates with discipline and consistency. With management continuing to stick to their plan of Lot Purchase Agreements, it allows them to be able to wisely allocate capital to projects without any long term commitment. While they might not be experiencing double-digit growth of other builders, they operate in such a way that will prevent them from taking on too much risk with little return. The focus to repurchase shares and return value to their shareholders makes this a great buy opportunity especially at current prices. For me, NVR represents a great value opportunity with modest growth potential and little downside risk. While I currently do not own stock in NVR, I plan to make this my next buy.

This article was written by